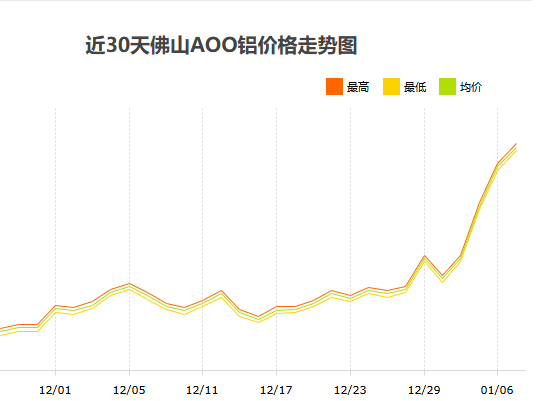

Global Aluminum Price Increase – Causes and Six-Month Outlook

Over the past several months, global aluminum prices have experienced a noticeable upward trend. This movement is driven by a combination of supply-side constraints, rising production costs, and strong demand across multiple industries. Below is an overview of the key factors influencing the market and our expectations for the coming half year.

1. Supply Constraints

Several major aluminum-producing countries have faced production challenges. In China, stricter environmental regulations and energy consumption controls have led to reduced smelting capacity in certain provinces. Meanwhile, geopolitical tensions and sanctions have disrupted exports from some regions, tightening global supply. Additionally, logistical bottlenecks, including shipping delays and higher freight rates, have further limited the availability of aluminum in international markets.

2. Rising Energy Costs

Aluminum production is highly energy-intensive, particularly in the smelting stage. The recent surge in global energy prices—especially electricity and natural gas—has significantly increased production costs. Many smelters have had to either reduce output or pass these costs on to buyers, contributing to higher market prices.

3. Strong Demand Recovery

Post-pandemic economic recovery has fueled demand for aluminum in construction, automotive, packaging, and renewable energy sectors. The transition to electric vehicles and the expansion of solar and wind energy projects have created additional demand for lightweight, corrosion-resistant aluminum products. This demand growth has outpaced supply, further supporting price increases.

4. Currency and Commodity Market Dynamics

Fluctuations in the U.S. dollar and broader commodity market trends have also played a role. A weaker dollar generally makes commodities more attractive to investors, while speculative trading in metals has amplified short-term price movements.

Six-Month Outlook

Looking ahead, we expect aluminum prices to remain relatively high over the next six months, with potential for moderate further increases. Supply constraints are unlikely to ease significantly in the short term, as energy costs remain elevated and environmental policies continue to limit production in key regions. Demand from the automotive and renewable energy sectors is projected to stay strong, while infrastructure projects in emerging markets will add additional pressure.

However, if global economic growth slows or energy prices stabilize, we may see some price moderation in the second half of the year. Businesses should plan for continued volatility and consider securing supply through longer-term contracts to mitigate risk.

Conclusion

The current aluminum price increase is the result of a complex interplay between supply limitations, rising production costs, and robust demand. While short-term fluctuations are possible, the overall market fundamentals suggest sustained strength in aluminum pricing for the foreseeable future.